U.S. Economy Shows Solid Expansion Across Most Sectors

Economists have revised upward real GDP growth forecasts for major economies worldwide, according to S&P Global, which forecasts 2.6% for real GDP globally and 2.4% for the U.S. economy. Whether a business depends on local, national, or international revenue streams, these projections are generally good news.

The second quarter of 2024 (Q2) looks like it will produce more growth than the first quarter. While Q2 is commonly the strongest quarter, if the Atlanta Federal Reserve Bank’s GDPnow indicator comes close, now at 3.6%, Q2 could be one of the strongest quarterly for GDP since 2022.

The 10-year average for U.S. real GDP growth is above 2.6%. If S&P’s forecast is correct, Q2 will be an average quarter for GDP. Meanwhile, unemployment in the U.S. economy is running near the historic low for this century.

Yet, inflation is proving stubborn —and has even increased for certain indexes—when viewed month to month. Even with economic data showing economic strength, small business owners are likely curious about their industry. With the Federal Reserve so recently deciding to hold rates where they are, here’s a breakdown of each major U.S. industry this month.

Housing

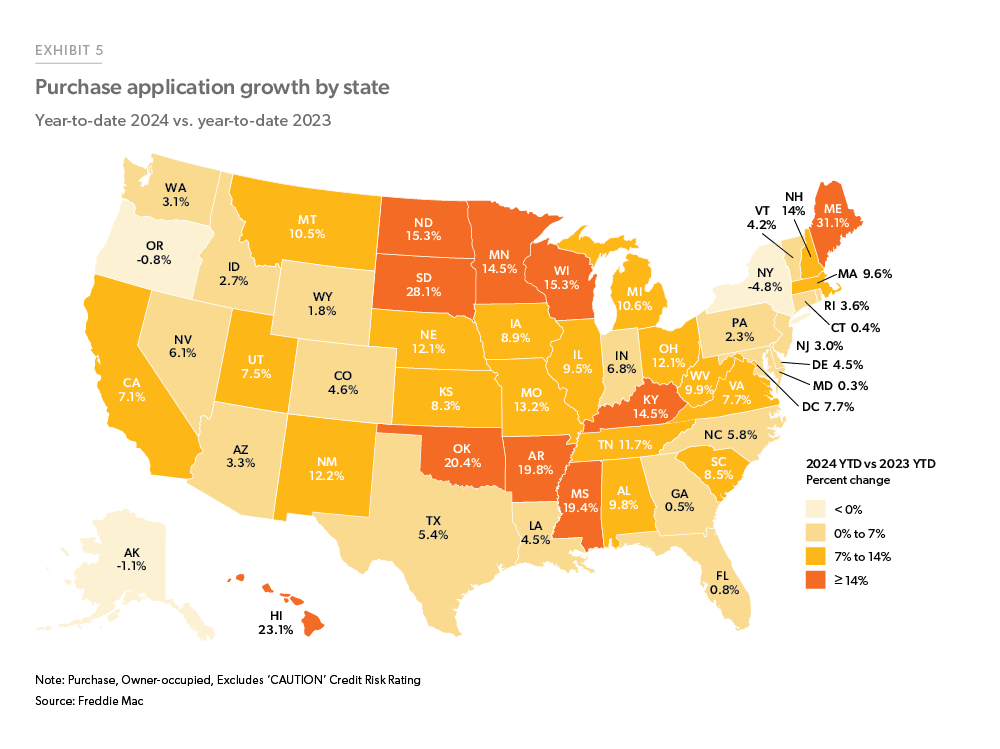

According to Freddie Mac’s April 2024 Mortgage and A preview of the spring homebuying season 2024 “shows a healthy recovery compared to last year,” the mortgage government-sponsored enterprise said. The Market Outlook states “First-time homebuyers continue to carry demand, making up almost 6 out of 10 purchase applications.”

For the state of Washington, Freddie Mac reported 3.1% housing sector growth in 2024 compared to the same point in 2023.

Retail

Monthly growth in retail sales (adjusted for seasonality) has been rising steadily throughout 2024, up from a marked low in January 2024, according to the National Retail Federation’s April Retail Monitor.

According to the retail monitor, “Consumer spending continues to drive economic growth and retail sales increases, though we see some moderation in spending as consumers continually search for value,” NRF President and CEO Matthew Shay said. “The ability to spend is supported by a growing job market and real wage gains. Overall, inflation remains stubborn because of elevated service prices, while inflation for goods has dropped to nearly zero. Consumers remain focused on value and price and are shifting their spending patterns where needed to make ends meet.”

Manufacturing

Manufacturing employment has surpassed pre-pandemic levels and has added 11% more manufacturing establishments in the United States during the last four years. Construction spending in manufacturing—dollars invested to build new or expand existing manufacturing facilities—has nearly tripled. It was up 37% year over year in January 2024.

For Q2, manufacturing has seen some headwinds, with business conditions failing to improve for the first time in four months, according to S&P Global U.S. Manufacturing PMI.

“Order inflows into factories fell for the first time since December, meaning producers had to rely on orders placed in prior months to keep busy,” said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. “However, there are some encouraging signs. Consumer goods producers reported a further strengthening of demand, hinting that the broader consumer-driven economic upturn remains intact.

As the industry looks at the years ahead, Deloitte projects manufacturers will have the revenues to increase the industry labor force by 3.8 million jobs by 2030.

Infrastructure Construction

Washington was among the leading states for adding construction jobs in March and April, according to the Associated General Contractors of America. The state added 3,100 infrastructure construction jobs, second only to Michigan.

National infrastructure spending is not posting huge gains over projections at the beginning of 2024, but it’s not floundering. The U.S. Census Bureau reported on May 1 that the national annual rate of public construction spending was up 1.5 percent compared to estimates earlier in the year. Likewise, educational and highway construction also achieved higher spending than projected in February, by 1% and 3.4%, respectively.

Commercial Real Estate

Commercial building construction contractors have expanded modestly over the past five years, according to industry information publisher IBISWorld. Overall, analysts expect industry revenue to fall 2.1% in 2024.

“Rent and occupancy growth was generally positive in Q1, albeit muted, [for commercial real estate],” according to speakers presenting the first quarter CRE briefing from Moody’s Analytics.

“Multifamily demand remains just strong enough to produce rent growth even in the face of a record pipeline of supply. Retail and Industrial performance is running slightly below average, but the national number hides some very strong property and location-specific growth. Office vacancies continue to rise as the remote work trial and error period continues; although suburban and emerging metro growth is evident in the data,” they said.

Solid Expansion

The Federal Reserve’s Federal Open Market Committee said on May 1 that recent indicators suggest that economic activity has continued to expand “at a solid pace.”

“Job gains have remained strong, and the unemployment rate has remained low,” the FOMC stated. “In recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective.”

Small businesses should join the FOMC in continuing “to monitor the implications of incoming information for the economic outlook.” For now, the U.S. economy is showing impressive signs of resilience.